The holidays have ended, and a new year has started. Some might have spent their holiday bonuses on gifts, parties, and more during the holiday season. Many are trying to save money for the year for various plans: traveling to another city or country, attending concerts, shopping, or saving for the future or emergencies. So, why is it important to save, budget, or plan financially?

Defining Budgeting and Saving

Budgeting involves planning and managing your finances and allocating income to various expenses, savings, and goals. It provides a structured framework to control spending, prioritize financial objectives, and ensure you live within your means.

Budgeting and Saving Tips

Budgeting

Use the 50/30/20 Rule:

- Allocate 50% of your income to necessities, 30% to wants, and 20% to savings and debt repayment. This simple formula helps balance essential spending, personal desires, and financial goals.

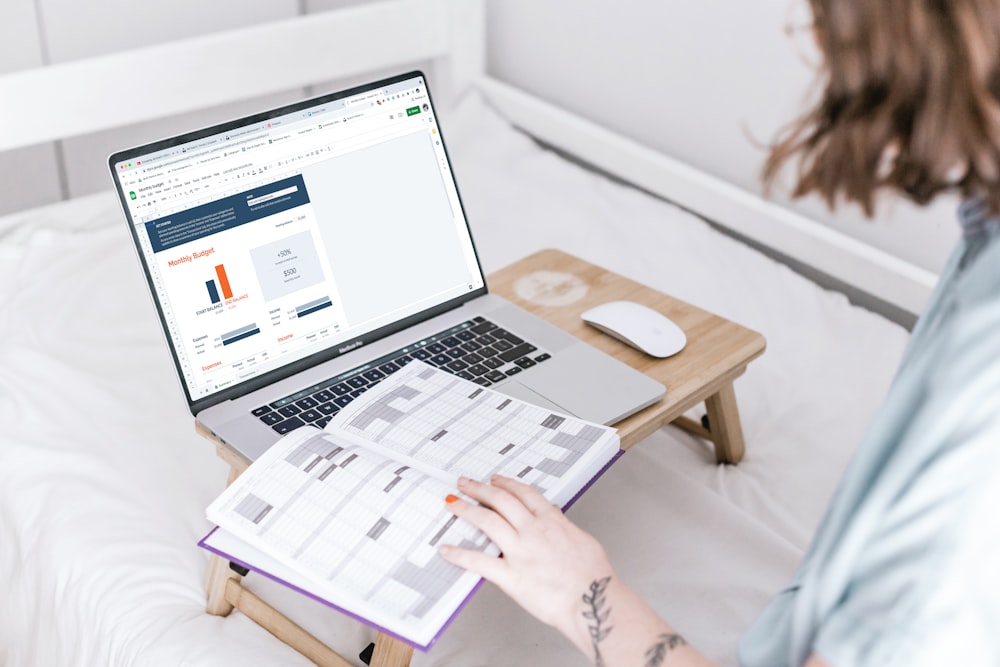

Track Your Expenses:

- Record all your expenses to understand where your money is going. Use apps or spreadsheets to help streamline the process.

Create a Realistic Budget:

- Based on your income and expenses, create a realistic budget that allocates funds for necessities, savings, and discretionary spending.

Prioritize Needs vs. Wants:

- Distinguish between essential expenses and discretionary spending. Prioritize your needs first and allocate the remaining funds to your wants.

Set Realistic Goals:

- Establish clear and achievable financial goals for the year, such as paying off a specific debt, saving for a vacation, or building an emergency fund.

Review and Adjust Regularly:

- Regularly review your budget and make adjustments as needed. Life circumstances can change, so adapting to your budget is crucial.

Saving:

Automate Your Savings:

- Set up automatic transfers to your savings account. It ensures that a portion of your income is saved without manual intervention.

Emergency Fund:

- Prioritize building an emergency fund. Aim for three to six months’ worth of living expenses to provide a financial cushion in case of unexpected events.

Save for Specific Goals:

- Identify specific short-term and long-term goals (e.g., buying appliances or gadgets, education, travel) and allocate funds toward these goals in your budget.

Take Advantage of Employer Benefits:

- If your employer offers retirement savings plans or matches contributions, take advantage of these benefits to maximize your savings.

Cut Unnecessary Expenses:

- Identify areas where you can reduce unnecessary expenses and redirect those funds toward savings.